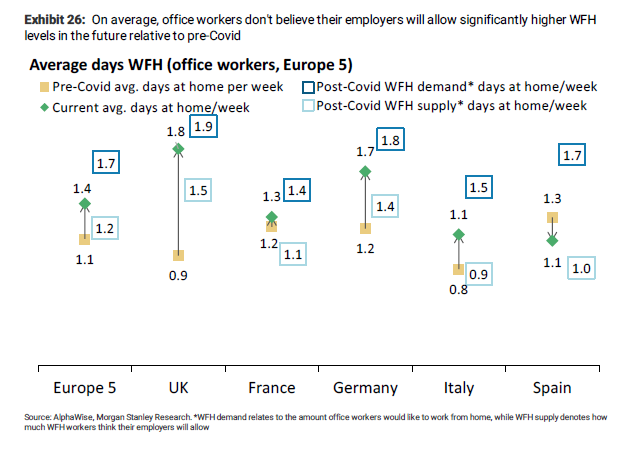

Although recent events suggest that managing Covid-19 remains a headache for us all, the baseline data that is coming through suggests that as restrictions lift and life normalises, people return to the office.

Morgan Stanley AlphaWise WFH Survey Analysis

The data suggests that pre-covid office working patterns are normalising, but that expectations have changed and that both employers and employees have learnt from 2 years of enforced experimentation and evolving their working practices. The key themes emerging from agility experiments that consistently rank at the top of the 'learning' list are:

- That employees and employers both value the cultural, social and career benefits of working collectively very highly. This requires them to collaborate closely in person with each other in a properly amenitised, high quality, well located workspace.

- That employees value the ability to choose to operate flexibly in pursuit of a better work/life balance, managing their face to face collaborative time more dynamically in response to their own personal circumstances. Employers understand that this is a valuable talent acquisition and retention tool and are willing to offer some flexibility in response.

It seems clear that if the combination of flexibility and office work is balanced carefully and proportionately, accommodating a little of each is a net positive, particularly in an environment where talent is scarce.

Culture and collaboration were already core to many business employer brand propositions pre-covid in high knowledge sectors and the concept of 'flex or gig working' was on the rise, so this is not a revolutionary change. That said, the marginal 'option' to work more flexibly is now far more fully ingrained into business practice and so it will not be easily taken back and, given the ongoing ‘war for talent’, we should expect it will endure in the post covid working environment.

The ‘optionality’ outcome is, nevertheless, really important because it impacts the way tenants think about space use. Optionality drives a highly flexible pattern of use. Employers tend to specify core collaboration days and, even if they don’t, the data suggests that staff tend to choose the same days to be in (so that they can maximise the benefits of collective collaboration). In practice, this means that if everyone attends the office on Monday, Wednesday and Thursday, or the firm specifies days/times then, on those days and at those times, the office will likely be at full capacity. If full capacity is reached on any one day (let alone 2 or 3) then it makes it challenging operating with less space, particularly if your space is old and/or poorly configured. Equally, if staff also attempt to cram 5 days of collaboration and meetings into 3 office days, then the office may be stretched to (or beyond) its limits, requiring a shift in the balance between desks and flexible spaces, more meeting and comms space and better amenities (which all require more investment in spaces, not less).

The evidence suggests that once a tenant has given their staff the optional right to choose, office based businesses cannot rigidly control occupancy, limiting the ability to make large scale space and cost savings. Given the marginal importance of rent cost relative to talent retention and acquisition in businesses that have a growth oriented mindset, this 'lost opportunity' may simply pass un-noticed as wed normalise and businesses expand. Such firms are far more likely to focus on the quality of space, design flexibility and amenity of their space.

Ultimately, the data suggests that in a high collaboration, high productivity setting where the office provides significant amenity and talent development benefits, the impact of agility of the level of current tenant demand is likely be a one-off, contained effect. In some businesses where flexibility was already an accepted norm, it may even be negligible.

While we cannot definitively state that some firms will not radically change their needs and shed space, we do now believe that we can now model the effect of agility into our overall demand estimates with more conviction. When combined with our supply forecasts, this allows us to draw clearer conclusions about the forward looking path for vacancy rates and rents. In turn, this brings us to our analysis of supply.

The ESG-led supply shock is going to be far more important that a demand-led optionality adjustment...

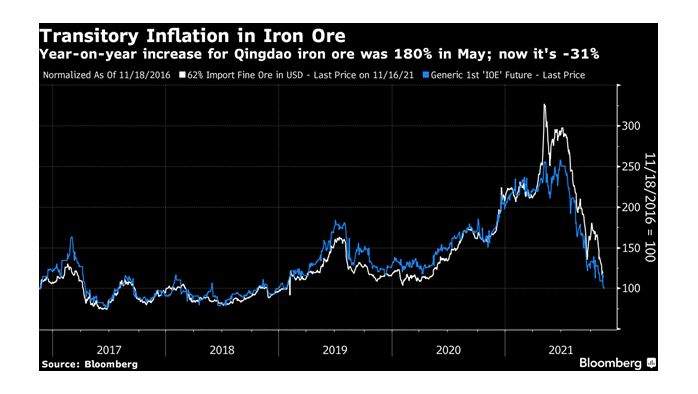

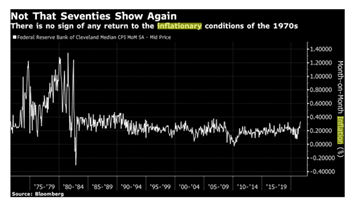

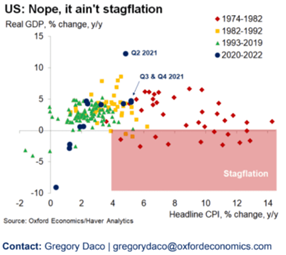

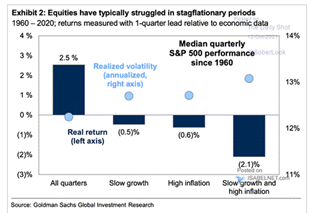

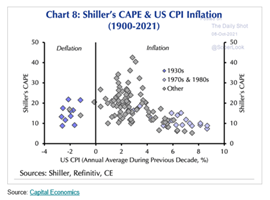

Recent macro-events suggest to us that the long-term supply-side effects are frequently misread when investors are confronted by a demand shock. No one cared about the second order effects of supply chain disruption 18 months ago when the world was locking down, yet today as demand normalises, people are realising that cutting supply chains creates bottlenecks that are difficult to remove quickly and this is having a profound effect on costs and prices. This effect is most pronounced in markets with inelastic supply-chains. Shipping costs rose five fold in the Summer, but the effect on the energy sector has also been notable. Energy is facing an ongoing secular shift to lower long-term demand, but despite the demand concerns, supply-chain disruption means that oil prices hit five year highs and doubled from the levels seen in the Spring of this year. Demand matters, but you cannot ignore the effect of supply on prices in inelastic markets.

Real estate supply is highly inelastic, particularly in office, and, in our view, the supply dynamics that are in play in office markets are significant. There are two specific supply constraint effects visible:

- a short-term halt in construction activity that is being triggered by a reduction in risk appetite from developers/investors and also by rising construction costs.

- a long-term effect that reducing the stock of assets for lease, associated with tenants increasing their focus on ESG and raising energy efficiency standards, forcing poor quality obsolete office buildings out of the leasing (and into the repurposing) market more rapidly than expected.

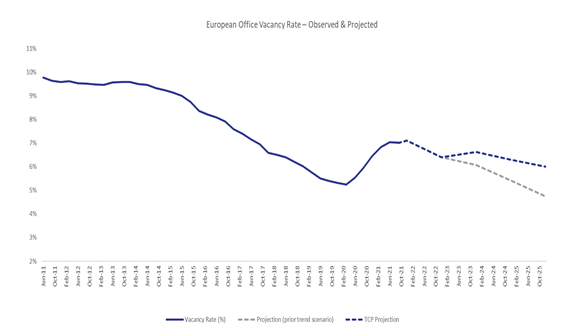

In practice, both the short and long run shifts will contribute to a reduction in the stock of ready to occupy high quality buildings in Europe over the next 3 to 5 years and potentially beyond. The short-run effect has already begun to change the expected path of short-term office vacancy. Our analysis of pipeline developments for 2022 and 2023 shows a 10% reduction in programmed office construction, which given a current vacancy rate of 7% and a modest bounce back in leasing activity associated with pent-up demand in 2022 is expected to mean that office vacancy rates will peak in the next 6 months at no more than 7.5%. To put this into context, this is the lowest peak vacancy level in European office vacancy cycle in the last 40 years. If tenant demand normalises to its pre-Covid levels, our forecast for office vacancy in Europe for 2024 is below 5%.

Tristan's Office Vacancy Forecast (Top 30 European Markets)

These dynamics and the lack of new construction will significantly limit the availability of grade A assets with high energy efficiency ratings and low carbon footprints during 2023 and 2024. Right now, brokers estimate that the stock of available ‘for lease’ Grade A assets is under 2.5% of total stock. As tenants crowd in to try to lease energy efficient highly-amenitised space, the Grade A vacancy number will reduce. It seems highly likely that the stock of Grade A for lease will be negligible until new development activity restarts, which given a 2 to 3 year construction lag means that Grade A supply will be close to zero in most markets until 2024 or 2025. In many markets it is possible to count the stock of ‘net zero’ offices that are ready to occupy in the next 2 years on one hand. In practice, given rising construction costs, we still may be using one hand to count NZC buildings with in 2025.

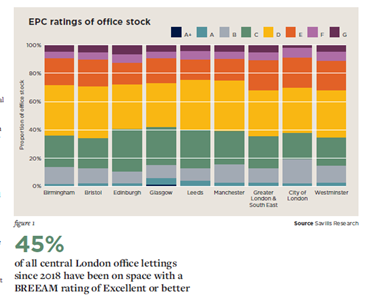

In addition, data on energy certification (see Savills chart below) suggests that a very significant proportion of the total stock of existing offices falls below minimum performance standards that tenants are starting to demand. In many markets, minimum energy efficiency standards are being written into government policy and regulated. EPC's are far from perfect measures for ESG purposes, but the data implies that a significant proportion of the built stock will need to be upgraded in the next 10 years, and moreover, that large number of tenants will be forced to trade up their office space or work with their landlords to upgrade space upon lease expiry. Tenants may shrink their space needs, the challenge they will face is that ESG factors means that the supply of buildings that they can lease will shrink even faster. 90% of the demand doesn't fit into 50% of the stock.

Energy Performance Certification by Office Market (Savills)

In the key innovation hubs where demand is growing rapidly and supply is constrained, scarcity has the potential to drive rental growth for well located, properly amenitised assets with high energy ratings. We can already see evidence of this in our portfolio in London, Birmingham, Dublin and Barcelona. Increasingly, it also seems likely that, given the lack of new supply and less construction activity, rising demand will spill-over from Grade A into a broader range of good quality, certified ESG assets.

Generalised office uncertainty may prove to be temporary, the greater challenge will be acquiring the skills required to manage the ESG risk properly...

Given the long shadows cast by retail, investors are understandably cautious on the office sector and the tone of the conversation in the investor community remains uncertain. While most LPs accept that good quality core offices are not on the same path as secondary shopping centres, and everyone knows that the market is tilted to the buyer, it is hard to gain conviction, particularly if you aren’t directly leasing buildings and seeing real time data points that allow you to triangulate and untangle the ESG and supply complexity.

Equally, even if you can unbundle the data, there is a limited number of skilled value added managers who have the ability to measure the costs associated with ‘greening’ an asset, can price the detailed capex requirements, juggle tenants and execute a complex ESG-upgrade business plan under such time pressure.

As a result, many may decide to forgo the office opportunity and buy even more sheds and beds at historically lower and lower yields. It’s hard to criticise this choice, but ultimately the crowds and the prices make will make it increasingly hard to outperform. People seeking mid-teens IRRs in the B&S space will need to forecast significantly higher rents or lean on some combination of granular assets, more financing risk and/or development risk. The reality if that there is no easy path to mid-teens IRR’s. Every strategy has its own risks and execution challenges.

Have a great weekend!

Simon