The Reality Check ... Transitory or Persistent?

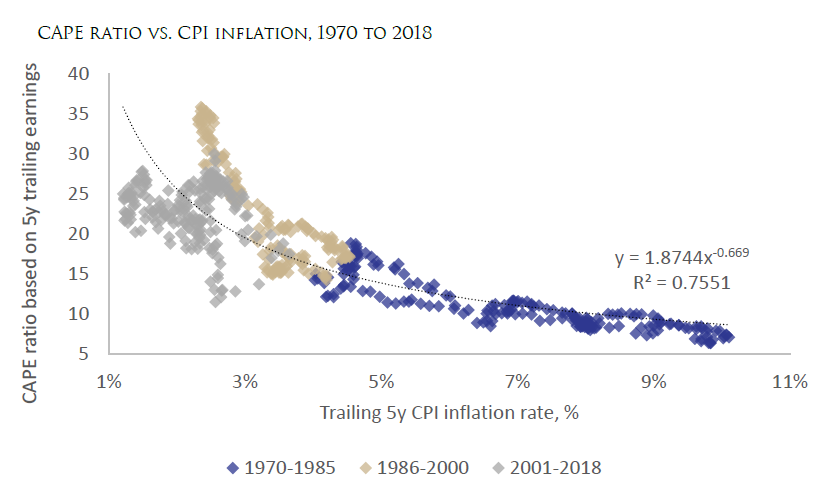

So a few days ago I was rummaging through some research that we have presented at prior advisory board meetings, when I came across this slide from our Spring 2017 meetings :

5 years on it still resonates. We continue to use exactly this data to help clients think about the effects of inflation risk and how it might shift allocations to our asset class.

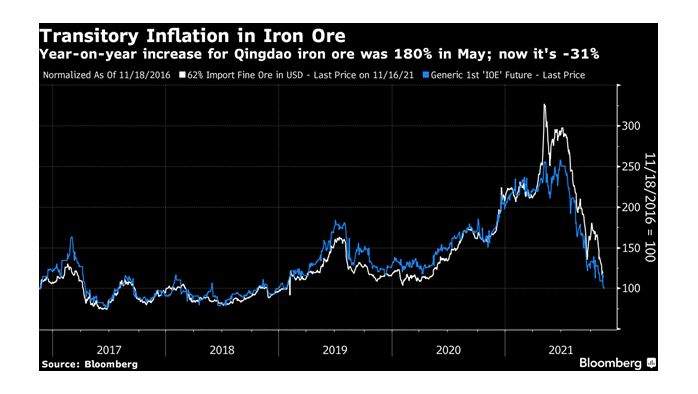

I also saw this chart today:

I was struck by this chart as it serves to remind us that not all price rises are persistent, particularly in markets where supply is relatively elastic.

This brings me to this piece of research from the BIS - the gist of which is that in the long run everything is transitory... I wish life were that simple!

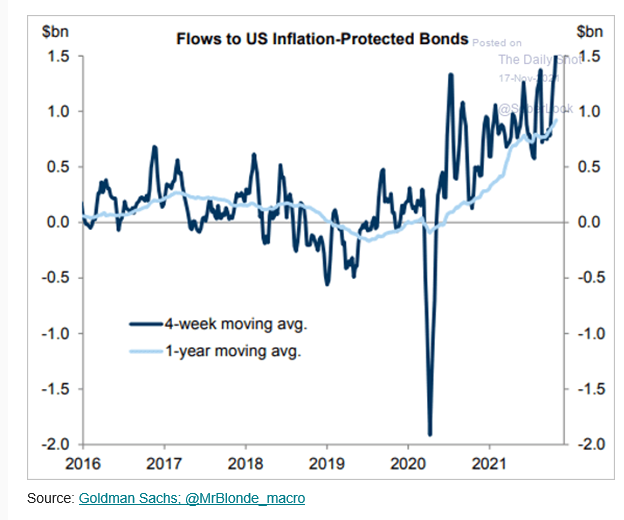

Ultimately the market doesn't have the luxury of 'forever'. Investors may be able to look past today's spot CPI, but they are acutely sensitive to the risk of inflation over the next few years, particularly given the current levels of real yields. This inflation risk is often viewed through the lens of risks around central bank policy error. If investors think that central bank error is likely and that this may lead to a persistent rise in CPI, then they will look to hedge that risk now.

Real estate attracts capital in these moments in time because supply tends to be relatively inelastic over the short to medium term. But in practice, the efficacy of this 'hedge' is really a function of the scarcity supply at your entry point and the persistence of supply inelasticity (i.e. how much gets built in response to the capital that flows in to take advantage of rising rents).

Sadly, if supply varies over time (which we know it does), no one has the luxury of thinking like the BIS - timing and entry point matter.

Have a great weekend!

Simon