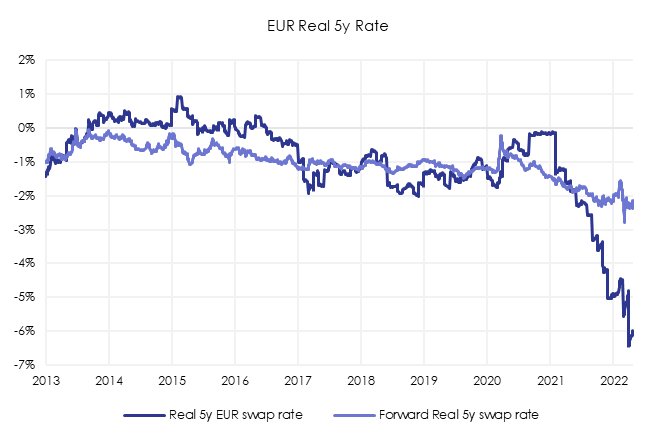

Last Thursday afternoon, the ECB made history. For the first time since its foundation, the European Central Bank cut rates before the US Federal Reserve. This marks a welcome turning point in the interest rate cycle after a period of significant turmoil and uncertainty. It marks the start of the process of 'normalization'.

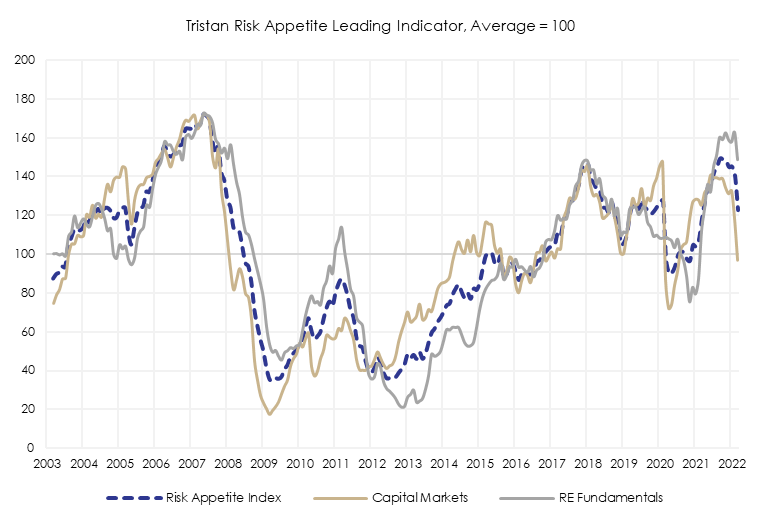

Rate turning points, like these, are of significant importance to investors in leveraged asset classes like ours. Typically, rate cuts are the first step in normalizing an inverted yield curve, and as inverted curves cut the supply of credit, the cut is also an opening salvo in the process of normalizing yield curves and credit supply. As credit cycles and CRE cycles are closely interwoven, big turning points in credit almost always catalyze turning points in the CRE cycle. So now is probably a good time to spill some ink on what we should expect as the rate, credit, and CRE markets start the process of recovery and a new cycle begins.

The first point to make is that new CRE cycles are not always made equal - they vary in tempo and scale. In our view, the best way to understand whether you are looking at a major turning point is to start by looking at the historic data on price indices. It doesn't take long to figure out that a full reset has, in the past, required a correction that reduces values by more than 20% in GAV terms (and that systemic +40% GFC event is an oddity given Q4 2008 and Q1 2009 accounted for almost half of the 43% correction that occurred). Put more simply, a GAV fall of 20% is more than enough to call a cyclical reset and the market dynamics that disproportionately favor people with capital over people who need it.

We like to fine-tune this heuristic by looking at price data in real terms and relative to trend over time, as shown in the charts below. You can look at it in nominal terms and un-trended, but we think our approach helps because it seems to be better as a tool to help us understand the underlying dynamics of each cycle.

Our approach identifies three prior 'Big-C' cycles - S&L crisis (1992), 9-11/tech-crash (2001), and GFC (2008) and it is immediately clear that these cycles have somewhat different dynamics. We can see in the charts below that the 2001 and 2009 recoveries in performance appeared almost immediately after the market bottomed, creating a visible capital value bounce. In 1993, the market correction completed, but the bounce was very limited out, and the market picked up slowly. A full recovery in performance really only started to accelerate in mid-1996 when real capital values began to tick up.

The difference in the pace and acceleration of these recoveries is, in our opinion, largely a function of the speed and scale of the policy response that came out of the central banking system in each case. In 2001 and again in 2009, rates were cut dramatically, and the system was rapidly flushed full of liquidity as inflation was collapsing. This wasn't curve normalization - these were emergency deflation abatement measures. They were an overwhelming show of force, and unsurprisingly the CRE market bounced back immediately, led by levered investors and cap rate compression.

The 1993/94 monetary policy cycle was different from the 2001 and 2009 inflection points. Bond yields initially collapsed when investors perceived recession risk in 1992/93 but yields stepped back up as investors were kept on their toes by surprisingly robust GDP growth and CPI volatility. The volatility subsided in 1995 and 1996 and the yield curve normalized and this was the catalyst for recovery in transactions and deal flows. However, normalization involved relatively modest moves in rates (and spreads between rates and CRE yields remained relatively thin) so while flows picked up, the cycle meandered. Capital value growth accelerated only when it became fully apparent that nominal growth was feeding into operating cashflows at the asset level. Rising rents drove a real recovery in investor returns, not levered yield compression. Levered investors focussed almost all of their attention on operating company investments, capex and development plays and sought out distress. Does any of this sound vaguely analogous?

To be honest, if you ignore all of this and simply focus on how important rental growth has been since 2023 (as the chart below shows), you probably have most of the information you need to estimate what will drive this recovery. In a higher cost of capital world, cash flow is king... just remember that cash flow-driven recoveries tend to build slowly at first, particularly when people are worried about CPI and the volatility of rates.

Those of us who were around in the 1990s will remember what this type of investing looks and feels like, and that, in practice, this does tend to favor people who know what they are doing when it comes to driving operating income at the underlying asset itself. For some, that will sound like (and can be) quite hard work, but it comes off the back of a big price correction, so people who make the right plays are going to get well paid for the effort.

We will come back to some potential 'plays' into this type of recovery in a second. First, we need to cover a bit more detail on timing and how the cyclical pathway impacts returns. The two charts on cycles show you broadly how timing the turning points has worked in prior cycles. As we have already noted, a significant divergence below the long-run real trend is usually a pretty reliable indicator of the bottom. If we take 'max divergence' as a reference point, adjust for the credit lag to estimate a start point for 'recovery' and do some simple math to calculate the total return on offer over the subsequent 5-year period, we can approximate the turning point effect (shown below) on returns.

As we can see, getting allocated close to the turning point in the market cycle when values have fallen below their real trend is almost always double-digit accretive for investors on a forward-looking basis. Note that this data is for core unlevered CRE based on the capital value indices produced by CBRE (and that unlevered returns in a diverse portfolio will typically be a couple of hundred bps lower).

So what are the immediate actionable implications of this analysis? If the analysis is correct and this is a double-digit return opportunity, and this new cycle starts with a 90's style phase of slow and steady recovery, there is an opportunity to do two (or three!) things now:

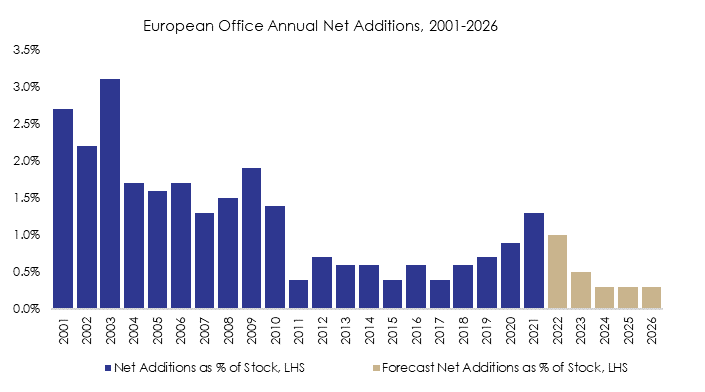

CRE Credit - The first, given a high nominal 3-month rate and Europe's floating rate lending approach, is to scale up private CRE credit exposure. Ultimately, credit will continue to do well in a rate environment that normalizes slowly, with an obvious bias to investing more while the curve is inverted/flat over the next 12 months. In practice, although a slow transition to a normalized rate environment will provide some relief to borrowers and banks, the more modest pace of capital growth and massive step up we have seen since in credit costs since 2021 will mean that borrowers will have to keep working hard to find alternative sources of credit to complete their refis. In practice, this will mean the cyclical demand for private CRE credit will continue to be high, and we think demand is likely to outrun supply in for several years to come. Our conviction around this scale-up opportunity is reinforced by clear structural change. Europe's adoption of the final layer of Basel 3 regs comes into force in January 2025. This final step (now known as Basel 3 end-game) will, in turn, tighten the rules on how CRE bank loans are rated and classified and make it significantly more expensive for banks to refi loan exposures with lots of capex, high LTVs, and low DSCRs. Evidence from markets where elements of this regime are already in place suggests regulated balance sheet lenders will permanently retreat to the safety of very low LTV lending on stabilized core assets and senior credit line lending to funds under these conditions. This leaves a yawning gap that private lenders will need to fill.

CRE Equity - The second opportunity is to start to leg into the equity. As stated we would expect that this will be a double-digit returning strategy on the basis of a typical cyclical upswing. Again, in a slow-burn upswing, the returns could remain rich for some time. However, experience suggests that it is always worth looking around to see where there might be immediate opportunities to take advantage of capital constraints to boost returns. We think this is visible in two places today:

We would look closely at core/core+ fund redemption queues to see if there are any immediate opportunities to pick up secondaries in high-quality funds. On a scaled basis, it may well be possible to buy into a good quality, well-managed, externally valued core/core+ fund off Q1/Q2 NAVs at 5-10% discounts. If this is the case, then we think it’s worth picking up the pen. If you can get a look through to the underlying CRE, have trust in the manager, are getting invested alongside institutional quality LP names and the NAV is independently verified, then, in our humble opinion, this is an immediate actionable opportunity.

Additionally, we'd look at opportunities to take advantage of special situations that occur as a result of refi pressures, recap needs, and idiosyncratic distress via the opportunistic equity funds. Everyone with risk-tolerant capital loves a motivated seller, a distressed creditor, or a developer struggling with a wobbly funding model. Given the scale of the correction we have seen in the capital markets and the challenges associated with a stepped-up rate environment, we think there is a clear window for opportunistic deployment as capital remains very scarce and hard to aggregate. Truly opportunistic windows don't last forever, because flows always come back. But if we do bump along the bottom in 90's style for a couple of years, there will be more than one mid-teens vintage.

When combined together, we would suggest that this debt and equity combination sets up an interesting 'barbell' for CRE positioning over the next few years. On one end, you may be able to print 8%+ coupons from relatively conservatively positioned whole loans secured on high-quality CRE, and on the other, you could very well be making 10%+ net on CRE on an unlevered basis with some upside optionality as the cycle picks up pace ... which you can build out quickly by hoovering up core/core+ secondaries (at a discount) and at the same cherry-pick capital-constrained sellers and special situations via opportunistic allocations. This is a full agenda for the next couple of years, but this is the life of people that invest in cyclical asset classes!

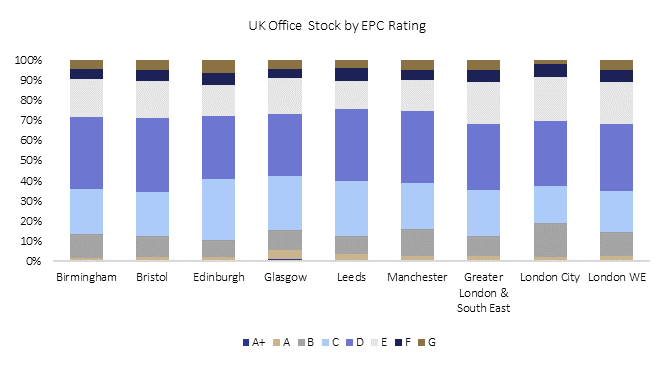

The last page turn in the playbook is positioning within the portfolio. This is particularly important today as we are in the midst of some pretty profound thematic shifts in the CRE market, centered around sector-specific secular trends. We suggest this is where you need think about a somewhat reworked playbook. Today's winning themes are not that likely to be the same as those that worked in the1990s. Even dinosaurs like me recognize it!

In our view, this is now largely about making sure you are allocating to sectors where nominal cashflows are likely to grow fastest (specifically secular tailwind-oriented themes where demand outruns supply and vacancy remains low) and to sectors where investors are willing to acknowledge that this cashflow growth is long term sustainable (i.e., investors are not worried about secular headwinds and idiosyncratic obsolescence risk). The harsh reality is that the playing a slow burn recovery in a stepped up rate environment may be a 'k-shaped' opportunity.

Please shout if you'd like to discuss any of these thematic upside ideas in more detail - we've done a lot of thinking about the the cycle, the changing nature of our market and how best to deploy capital in this ever-evolving world. Timing remans as important as ever, but we think the changes in portfolio structure that we will see in our clients portfolios are also really quite profound. Equally, as you know, I am always willing to elaborate!