The Reality Check - the whiff of recession brings with it a change in risk appetite and an opportunity...

The statement that real estate investing is all about ‘credit and cranes’ feels like an over-simplification, but the reality is that ... for the most part ... it’s as true today as it has ever been.

How should we think about ‘credit’ given the inflation uncertainty we are faced with?

Ultimately when we reference credit what we are really saying is that we believe that real estate markets work well when credit conditions are accommodative. Our view of credit conditions is largely determined by the level and stability of real rates. Real interest rates are important because they determine how capital gets allocated. Negative real rates encourage people to invest capital and tend to boost and support GDP growth. Positive real rates encourage people to store capital and slows growth. The choice of a negative or positive real rate inflation is largely driven by inflation risk. Central banks worried about inflation tend to push for a positive real rate seeking to slow the economy, central banks worried about deflation choose a negative real rate.

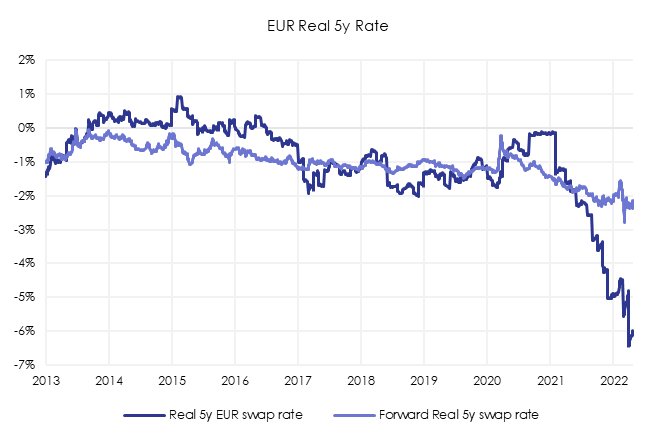

Chart 1 – Real Rate Outlook in Europe

Ideally real rates should hover around zero with a slight negative (pro-growth) bias to maintain high levels of employment and stable incomes. Rate stability is viewed as particularly important as capital markets are alert to the risk of instability, largely as this raises the risk of central bank policy error as this has, in the past, triggered recessions. Selfishly, a negative (but stable) real rate environment also represents something of a goldilocks environment for real estate investors, as it creates a positive economic tailwind behind leasing, drives allocations in our direction (from bonds) and allows us to safely make use of moderate leverage, which is highly accretive.

Ultimately part of the challenge we face right now is that the current spot (trailing 12-month, quarterly and monthly) CPI has become unstable. Real rates as measured by the different measures of spot CPI have thus become hard to predict. Coupled with this, the popular measures of spot CPI and the market implied levels of long-term inflation expectations have diverged. The data are sending us mixed messages and capital markets are therefore on alert for a policy mistake, fearing an ‘over-tightening’.

The reality is that the answer to the inflation conundrum is partly about looking past the spot metrics and paying more attention to medium term expectations (which are more stable as shown in Chart 1) and partly about refocussing on the effects of rising prices on real incomes and wages. Across a broad range of European countries there are signs that the sudden and unexpected rise in commodity prices associated with the Russian invasion of Ukraine is squeezing real incomes. Wage growth is not offsetting this effect and that this in turn is slowing down economic activity.

Chart 2 – Economic Outlook

|  |

The major sentiment and economic leading indicators have all rolled over and we are already seeing some flash GDP data suggesting that Q1 2022 saw the economy flatline. The educated narrative in the economics community has already begun to pivot from a discussion of the risk of policy error to the discussion of different soft-landing scenarios. There is a distinct whiff of recession in the air. If this is the case then investors should look at long term implied inflation expectations to understand real rates, not spot CPI.

In Europe, the discussion of recession risk is starting even before the central bank has begun the tightening cycle. Whatever the narrative, it now seems as if energy price inflation has done some of Madame Lagarde’s job for her. If the current energy price hikes are, as we expect, worth the equivalent of 100-200bps of monetary tightening in Europe, given a steeper EU yield curve and a tightening of credit conditions as economic growth slows, Madame Lagarde may be about to do a ‘Trichet’ and complete a full monetary policy cycle without noticeably raising short term rates. We may not be at the end of the tightening cycle yet, but the implication is that the risk of European policy error may be reducing. Under these conditions the path of real rates will not change substantially. Yield curves may flatten and the probability of inversion rises. Real rates would thus remain negative. This would allow investors to focus on the business of allocating capital.

How should we think about ‘cranes’ given the outlook for the economy?

In practice, when the risk to rates subsides, most risk tolerant investors will quickly turn their attention to the opportunities that a slowdown in the economy might offer. Coming, as it does, at a point where there has been very little construction for 3 years and grade A vacancy is sub 3%, the discussion of ‘how cranes impact our sector’ will resume.

Chart 3 – Vacancy & Construction Costs

|  |

The dearth of new construction can largely be attributed to the lingering effects of covid. The pandemic disrupted existing construction works and caused many developers to delay construction starts. Now the construction cost inflation we are experiencing is making it harder to justify new building until rents go up, further slowing the pace of activity. Low vacancy will therefore persist and the challenge of developing will not get any easier if economic uncertainty impacts financing markets and risk appetite over the coming 12 months. The prospect of a sudden surge in new supply looks very remote. Development is an inelastic business, so parts of the real estate market could remain acutely supply constrained for several years, certainly over the next 2 years.

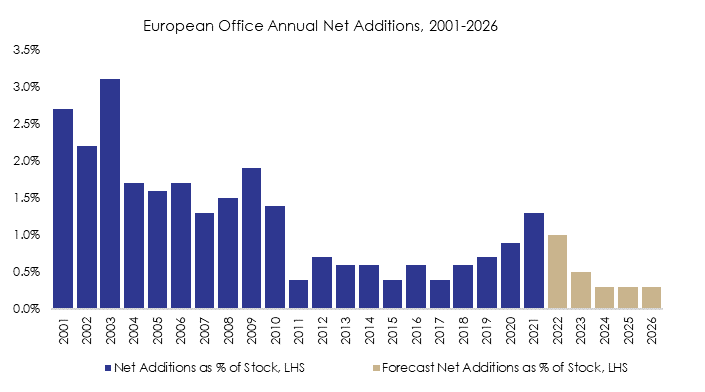

Chart 4 – New Development Activity

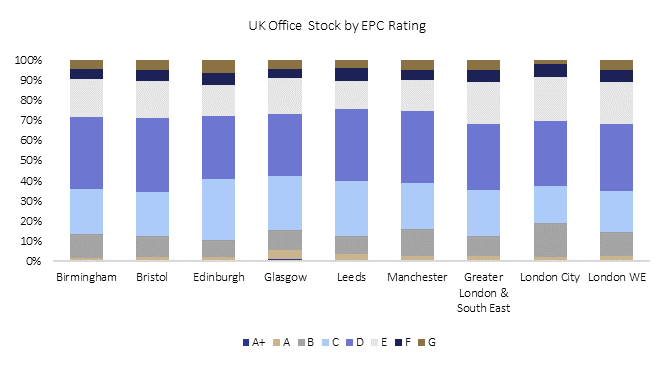

Short-term supply chain, cost and financing issues may be further exacerbated by tenant needs centred around ESG. We have written extensively about our views on the way in which ESG is accelerating change in our market. The energy efficiency requirements being stipulated by our tenants are narrowing the range of buildings that corporates consider to be acceptable for long term occupation across all sectors and property types. This shift is now being reinforced by regulations that will begin to limit landlord ability to lease buildings with poor energy efficiency ratings.

Chart 5 – ESG Factors

This ESG ‘shock’ is a disruptive change that will reduce the inventory that is available to tenants. In our humble opinion, it has the potential to be every bit as impactful across sector as the impact of ecommerce was for retail assets. What is notable right now is that it is funnelling demand into a relatively small inventory of highly amenitised appropriately accredited buildings when, in true real estate style, the supply of these buildings is at an historic low, particularly in high knowledge cities. Rents will (and are already) going up for these assets. It will not be long before investors begin to differentiate these assets and prices adjust accordingly. Thoughtful investors have been adapting for this environment for some time and this ESG paradigm will remain firmly at the centre of the way we design our strategies and invest capital.

How best to adapt strategically in this changing environment?

The combined effects of post-covid recovery, geopolitics, a climate crisis and ‘tech disruption’ makes it very challenging for investors to control risk. Markets continue to evolve and change rapidly and the outlook continues to be volatile and uncertain. Investors in our asset class in this environment need a clear top-down vision of what makes sense and the ability and platform to get allocated to the right strategy quickly. At the same time they need the discipline, vision and entrepreneurial instincts that will allow them to pivot, adapt and reallocate. Likewise, as the delta between winning assets and loosing assets will be significant, investors will also need the bottom up asset management acumen and reach required to manage the challenges associated with ever changing tenant needs in a broad range of different geographies and across sectors.

Some investors will find this complexity all too much and a few will panic and sell up, but this should be an environment where managers with the requisite skills, platforms and vision to build conviction and execute on their ideas can make profits for their clients. We expect that better equipped investors will stay the course, and those that are well equipped will rub their hands and double down.

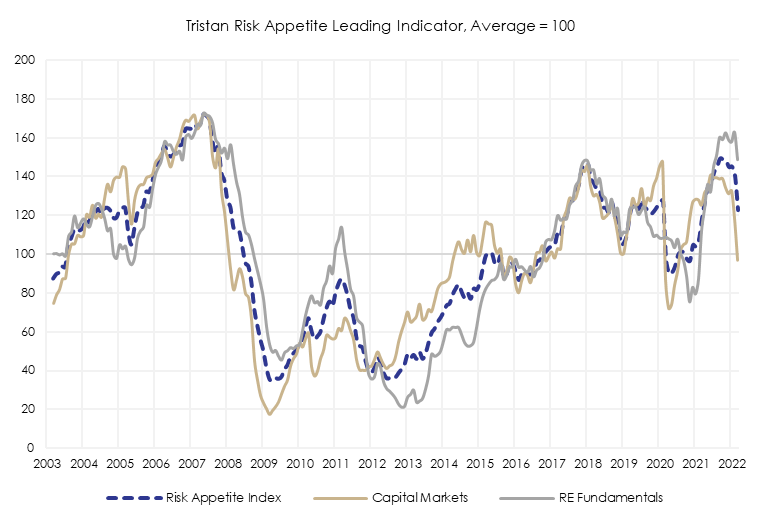

Equally, right now, with the economy slowing and risk appetite reducing, we believe the window to take advantage of this opportunity may be opening. As we have discussed we see strong evidence suggesting that economic growth is rolling over and we expect credit is will become harder to find, particularly for risk assets. Our risk appetite leading indicators suggest that the competitive landscape is shifting in our favour.

Chart 6 – Tristan Risk Appetite Index

These windows don’t come along often and they don't remain open for long. History tells us that the RE investors that accelerate deployment into these windows tend to consistently outperform.