Let’s talk about the reality of 'soft-landings'…

This section of text - abstracted from Bloomberg yesterday - came at just the right moment. Despite manny people continuing to espouse the consensus view that an economic ‘soft-landing’ is on its way, over the last few weeks we have had a lot of inbound questions from clients concerned with the risks around ‘recession’. These calls have become more frequent in light of the clear slowdown now visible in Germany and the UK economies.

When most people talk about recession - they think of earnings or GDP. Maybe it's because we spend alot of time talking to US clients or perhaps it's something to do with being in real estate, but for us (like the authors here) divining a 'recession' is not really about GDP growth rates or earnings cycles - it's really about jobs.

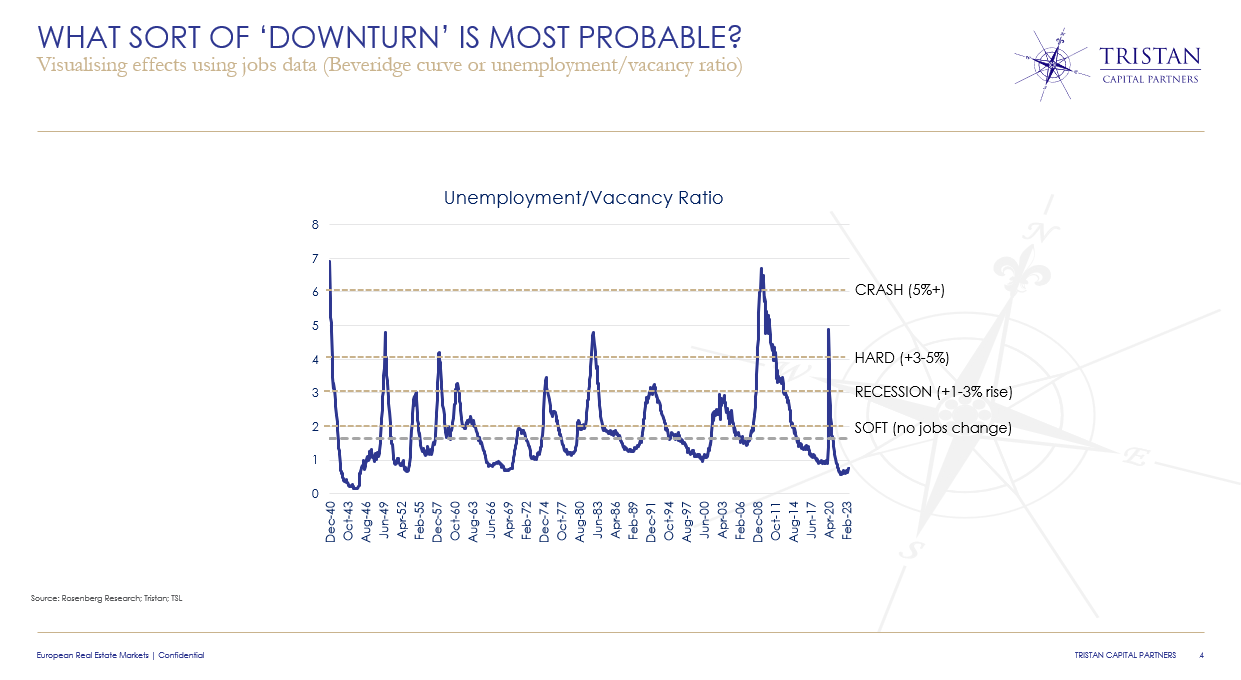

There are lots of rules, models and curves when it comes to measuring jobs and recessions (Sahm, Beveridge, etc) - but we think one of the best ways to look the impact of employment is by comparing the unemployment rate with the job vacancy rate as a ratio ... as we show here below ...

This chart shows you just how difficult it is for central banks to control the effects of tightening cycles - as the passage from Bloomberg says:

'once unemployment starts to rise it rises by a lot...'

In the case of our 'ratio' this 'step shift' is very clear because rising unemployment and falling vacancies are concurrent and this magnifies the 'signalling' effect. Nevertheless, it makes for a great indicator and it also gives you a real sense of what people mean when they use phrases like 'hard-landing' or, for that matter 'soft-landing'.

Ultimately - we believe this shows is that there are actually 4 ‘states’ of ‘recession’ - and reaching them in turn depends on the policy errors/risks of financial accidents and contemporaneous feedback loops that exist in our complex financial and economic eco system. In basic terms you have:

- 'soft-landing' - slower growth but no significant jobs impact

- ‘normal-recession' - a garden variety slowdown with a 1-3% loss of jobs

- 'hard-landing - a significant downturn with 3-5% job loss

- 'crash-landing - a serious deflationary downturn with 5%+ job loss

So what does this mean for the current cycle?

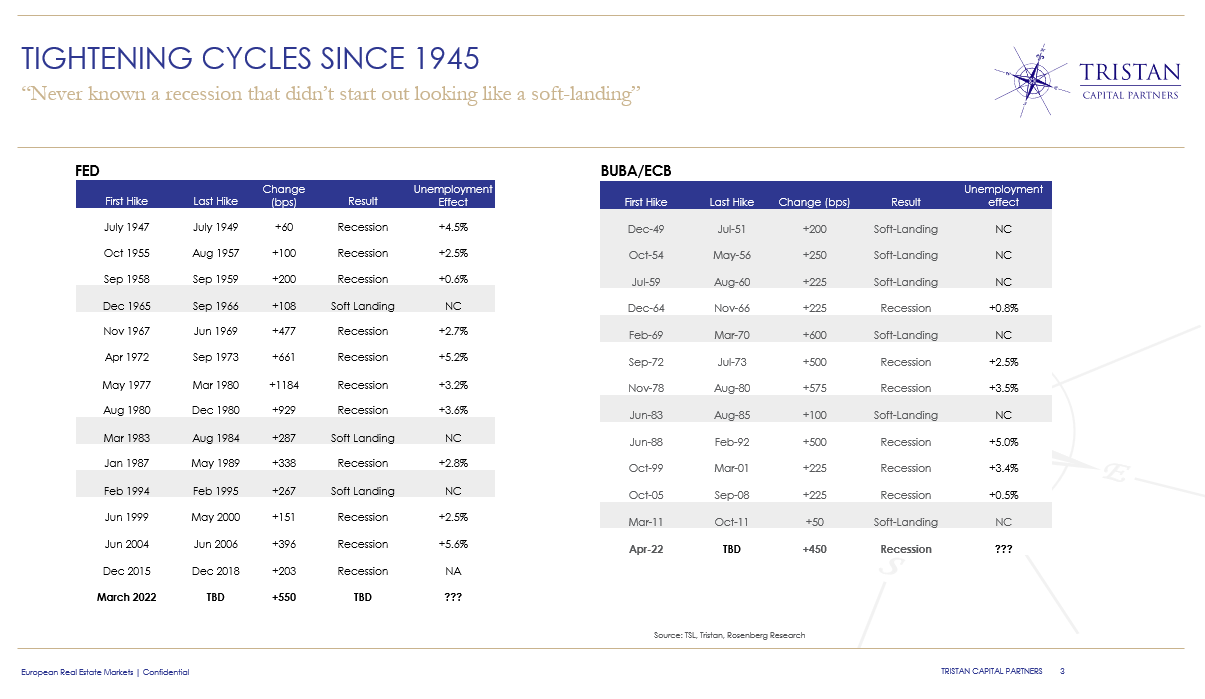

So here is the tough piece - the landing zone for a 'soft' touchdown is in practice quite small ... and while it is not impossible to achieve, it just doesn't happen very often. John Auther’s put it quite nicely in this excerpt below:

Equally as the table below the probability of a ‘soft outcome’ even lower when the tightening cycle comes quickly and in scale. Large, rapidly redeployed tightening cycles don't tend to be suited to 'soft-landings'.

In fact - the only soft landings we have seen (at least using our definition) in modern economic history have only happened when the Fed tightened - broke something in the financial system - and then quickly eased off before the prior tightening had shifted the needle on jobs. The problems with these 'soft-landings' is that within 12 to 24 months the Fed is then tightening again. IMHO this is the genesis of the discussion of ‘higher for longer’. It seems to us that if the policy concern is inflation volatility and wage pressure via a tight labour market, and the solution is tight monetary policy, then a recession avoided is simply a recession delayed. The odd’s are stacked against the consensus, as Greg Ip recently put it in the WSJ - "every recession starts out looking like a soft landing... ".

To that end - a ‘normal’ recession now is, ironically, probably a good thing - next step if for the central banks to time its easing in response to a weakening labour market to ensure that recession is not morphed into ‘hard-landing’. As CPI is moderating and weakening the job market seems to be slowing (particularly in Europe), we have no reason to expect anything worse ... or indeed better.

Who knows ... maybe a soft-landing is a shoe-in and the probabilities (as defined by 70 years of history) could be proven wrong ... maybe demographics have changed the calculus in labour markets …geopolitics could certainly toss us a curve ball … we know from past experience that nothing is truly certain or completely assured.

My personal view is that given the scale and speed of the tightening it will be very challenging to land in the ‘soft zone’, particularly in Europe. Stopping an economy on a sixpence is hard when you go from gunning the accelerator to slamming on the brakes, particularly in wet weather.